What Is Travellers Check?

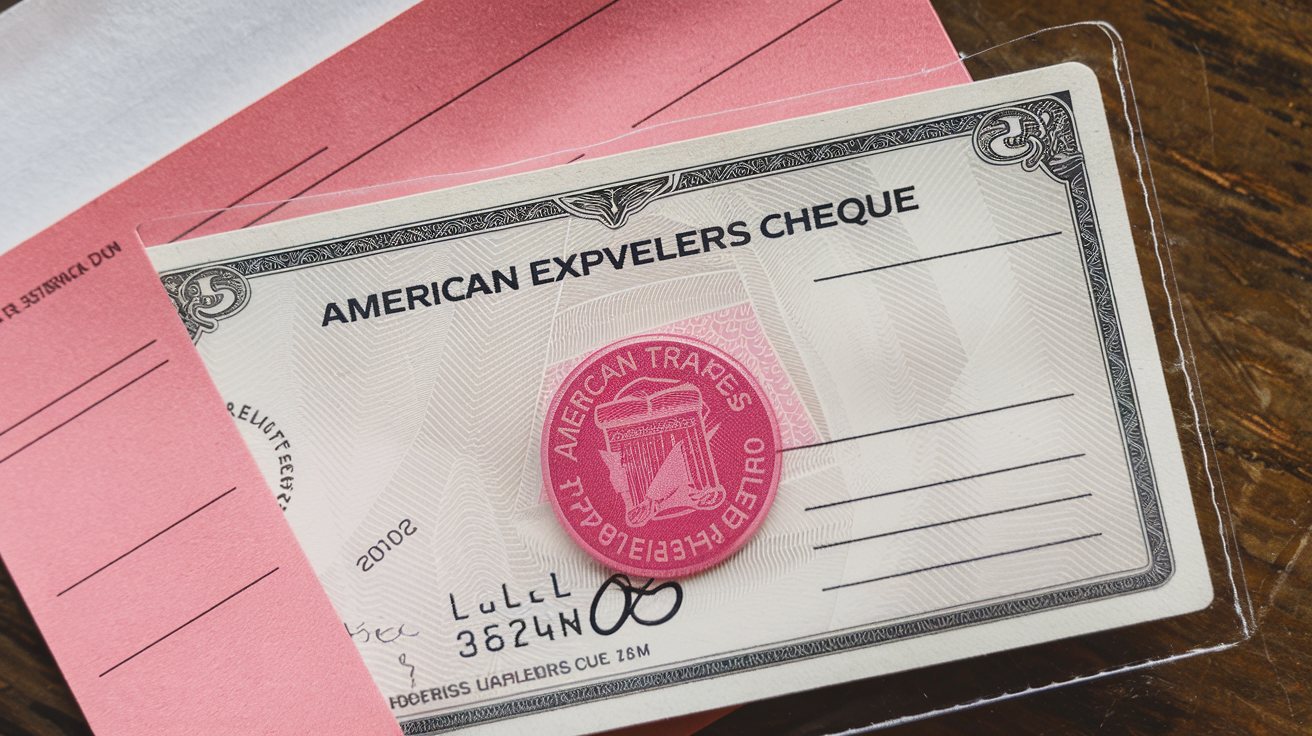

A travellers check (or traveler’s check) is a payment instrument similar to cash used by travellers as a security measure while traveling. It operates the same way as a cashier’s check; in fact, it’s a prepaid instrument that can be used to pay for products and services while in the domestic or international territory.

What Are Travellers Checks?

Travelers cheques on the other hand are cheques that have been given a face value and can be used to pay for goods and services during travel. They were developed in the early part of the twentieth century as a less risky method of moving money over large distances or internationally. They come in different denominations and the customer pays the amount in advance to the bank or a financial institution. They bear the signatures of the traveller and are meant to be countersigned at the time of use and for security reasons. This double signature system ensures that people who have lost or misplaced checks cannot encash them.

If the checks are really lost or stolen, the owner can report that and the lost checks value will be refunded. This is safer than carrying cash as one can easily misplace or get the money stolen by a thief. Large organisations issuing travellers cheques over the decades have included American Express, Visa, MasterCard, and Thomas Cook.

Benefits of Using Travellers Checks

- Secure – They can be replaced if they are lost or stolen unlike cash

- Widely accepted - Like AMEX, Visa and others, there is wide acceptance of these currencies.

- Prepay in local currency for this reason alone: Avoid Exchange Rate Fees

- Better Exchange Rates – You have exchanged a rate compared to exchanging cash

- No ATM Withdrawal Fees – Unlike getting cash from a debit/credit card

In this case, it is important to understand how travellers checks work so as to make correct decisions and be safe when using them.

To be more specific, travellers checks are cash vouchers, which need to be filled in with a certain amount of money before being used. They can be obtained from famous companies, which include American Express or Visa. Customers buy them for the required currency and specific denominations, using a form of payment including cash, debit, credit, etc.

The purchaser then becomes the sole user by endorsing every check written the minute it is written. This first signature serves as identification. When traveling and making a purchase, the user endorses or countersigns the check at the merchant in the presence of the person who accepts it. The merchant can ensure that the two signatures are of the same person before cashing the check.

In the event that the checks are lost or even stolen, the purchasers can simply contact the company that issued them and get to be compensated for the amount. This serves as anti theft that cash obviously lacks. In regards to the reissuing of fees and policies, there is a wide range of differences between travel check companies.

Pros of Using Travellers Checks

- Lost or Stolen – If this happens, it can be replaced – The reporting process enables a person to be reimbursed.

- Global Acceptance – Large issuers are accepted globally

- Prepaid Instrument – This method is used to lock in exchange rates by denominated in destination currency.

- No Fees – No atm fee, credit card foreign transaction fee, etc.

- Safer than Cash – Two signature security method

- Convenience - It is available in small quantities that are easy to transport due to the tiny containers.

Cons of Using Travellers Checks

- Less frequent - The circulation of these tokens reduces as the means of payments change.

- Added fees – They include issuance and replacement fees which increases the cost of the item.

- Paper Clutter - Shifting papers from one place to another, and tracking papers is uneasy.

- Refund Delays – Reimbursement time is usually not standardized once loss or theft has occurred

- Limited flexibility – Prepaid plans are often sold in fixed denominations of time or data allowance.

Travellers Check in the Future

Although they were once widely used, modern travelers checks have become much less popular in recent decades due to electronic payment methods that are faster and at least as safe. The debit and credit card networks are now international and the new peer-to-peer systems through smartphones allow the exchange of electronic money. These new approaches offer protection of digital assets, real-time exchange, fluctuating exchange rates, and increased merchant acceptance.

However, travellers checks remain to provide certain special forms of shield and assurance of exchange rate that is fixed as per one’s trip type or demographic preference. Nevertheless, further advancement in consumer payments is expected to reduce demand even further. Today, companies such as American Express offer prepaid debit card products with similar travellers check-like features included as corporations continuously diversify their offerings.

In a nutshell, travellers checks work as prepaid checks which offer security, fixed denominations in the destination currency and can be replaced if lost or stolen. They used to be popular in the last century when cash and cards had more restrictions worldwide. However, with the technological development of such electronic payments, their market and the need for traditional paper travelers checks still decreases. Their uniqueness is still relevant to some segments of the travel market, however.

Read More:

FAQ

What is a traveler’s check?

A traveler’s check is a pre-paid, fixed-amount paper check designed to function like cash for travelers. It offers additional security because, if lost or stolen, it can be replaced. It was once a common way to carry funds abroad

How do traveler’s checks work?

When you purchase a traveler’s check, you sign it. Then, when you want to cash or use it, you countersign it in front of the merchant or bank employee. This dual-signature system helps prevent unauthorized use

Are traveler’s checks still widely used?

Although traveler’s checks have largely been replaced by credit, debit, and prepaid travel cards, they are still accepted in some locations. However, fewer businesses and banks handle them compared to decades ago

Where can I get traveler’s checks?

Traveler’s checks can be purchased from banks, credit unions, or financial services companies like American Express. You can buy them in various currencies and denominations

What should I do if I lose my traveler’s check?

If your traveler’s check is lost or stolen, you can report it to the issuer. Most issuers, such as American Express, provide replacements for lost or stolen checks

Recent Blog

- Greece Travel Guide: Best Places to Visit

- Best Place to Visit in Hawaii: Top Destinations Revealed

- Hidden Gems: The 13 Most Beautiful Places on Earth

- Top Activities: Things to Do in Chicago

- Ultimate Guide: Top Things to Do in Nashville

- Best Place to Visit Europe: Top Destinations

- How to Travel Cheap in Europe: Budget-Friendly Tips and Tricks

- Can You Travel When Pregnant?

- Can You Travel North Korea?

- Can North Koreans Travel?